Physician’s Health Plan Of Northern Indiana (PHP) offers affordable medical insurance to residents of 40 counties. As a regional carrier, they participate in the State Exchange Marketplace and Open Enrollment that typically begins in November of each year. For 2016 effective dates, the OE period was from November 1 to January 31. After that period, Hoosier residents can apply for a plan utilizing a special exemption, if applicable (SEP).

Single and family “Indigo” policies are available along with a federal tax subsidy that could substantially lower rates. To be eligible for financial assistance, the entire income of the household must be less than 400% of the Federal Poverty Level. For example, the approximate maximum income to qualify for a 50 year-old individual is $47,000, $63,000 for a married couple, and $98,000 for a four-person household. However, policies are offered to applicants that exceed these income levels.

PHP is a non-profit (and tax-exempt) company that is manged by physicians and business owners in the area. Founded 30 years ago with headquarters in Fort Wayne, their provider network consists of more than 10,000 hospitals, specialists, dentists and doctors that specialize in wellness, prevention and a strong patient-physician relationship. In addition to medical plans, PHP also offers life, vision, dental, disability and third-party administrative services.

“MyNurse 24/7” is a free benefit for all active policyholders. A 24-hour toll-free nurse line is designed to offer assistance after hours when your primary-care physician’s office may be closed. You can speak to live licensed nurses that will provide information and recommendations, based on the information you provide. Of course, emergency medical situations should be handled differently.

Which Physician’s Health Plan Options Are Available On Indiana Health Exchange?

Listed below are available policies with a brief description: A summary of benefits and coverage (SBC) can be provided for all plans. The Department of Health and Human Services, Labor and Treasury provides a comparison tool. Upon request, we can also provide a pdf file with complete policy details.

Catastrophic Tier

Marquee Catastrophic 6850 – $6,850 deductible applies to all services. 0% coinsurance so 100% coverage after deductible is met. Exception, however, is made for primary-care physician (pcp) office visits. First three (per person) are fully covered. All applicants must be under age 30 to enroll in this plan.

Bronze Tier

Marquee HSA Bronze 6000 – HSA-eligible plan with $6,000 deductible and $6,550 maximum out-of-pocket expenses. As the cheapest HSA option offered by PHP, this policy is ideal for households that have very few medical expenses, and are seeking additional tax deductions.

Marquee Bronze 5000 (HMO and POS) – $5,000 deductible with $50 copay for pcp office visits. Generic drug copay is $25.

Marquee HSA Bronze 3750 – Lower-deductible HSA option ($3,750) with 40% coinsurance.

Silver Tier

Marquee Silver 2000 – $30 pcp office visit copay, and $15 generic drug copay with low $2,000 deductible. This plan is PHP’s least-expensive Silver-tier option.

Marquee Silver 2500 – Similar to previous plan with $2,500 deductible and lower generic drug copay ($10).

Marquee HSA Silver 3500 – HSA-eligible plan with $3,500 deductible and maximum out-of-pocket expenses of $4,500. $300 additional copay for emergency-room visits.

Gold Tier

Marquee Gold 1250 – $1,250 deductible with maximum out-of-pocket expenses of $6,850. $35 pcp office visit copay with $15 generic drug copay. Preferred brand drugs also only have to meet a copay ($45). Coinsurance on this plan is 10%.

Platinum Tier

No available plans

The Indigo series of 2016 plans consists of traditional, catastrophic and HSA options. Traditional policies mirror employer-provided plan and are typically the most expensive policy. Out-of-pocket expenses are lower compared to the other two types of coverage. Indiana Health Exchange Rates on all companies are available through our website by using the “free quote” feature.

Catastrophic contracts are the cheapest policy since many benefits other than illness and accident are limited or not covered. The HSA policies combine high-deductible coverage with 100% preventive benefits with an option to deposit tax-deductible funds in a separate account. If you already have an existing HSA, you can continue utilizing that contract.

Special Eligibility Requirements For Catastrophic Plans

Important: Catastrophic tier contracts are not for everyone. You must qualify, and meet specific eligibility guidelines. If you are under age 30, you can purchase these special low-cost plans at any time. They are available to single and married persons, including students.

However, if you are 30 years old or over, you have to qualify for a “financial hardship” exemption, which allows you to purchase the policy. Regardless of your household income, a federal subsidy will not apply. Therefore, in many situations, a “Bronze” plan may be a cheaper alternative. Bronze-tier plans will also offer more extensive benefits.

Network Providers

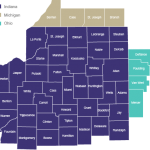

The PHP provider network is fairly extensive and can be accessed online. You can also obtain a hard copy to be mailed to you. The principal organizations that are used for physicians, specialists, hospitals and other facilities include the select network, Sagamore, Lutheran Preferred, and Three Rivers Preferred. By utilizing providers “in-network,” costs are substantially reduced because of prior agreements and the service area is illustrated below:

Join a YMCA, Health Or Fitness Club And Save!

It’s easy money. By showing your identification card, you may be eligible for discounts up to 25% from many fitness facilities. Some of those facilities include:

Breeden YMCA

La Porte YMCA

Huntington YMCA

Fort Wayne YMCA

Anytime Fitness

Miracles Fitness

Wildwood Tennis & Racquetball Club

Eastlake Athletic Club

Kroc Center

FitZone (Women)

The American Red Cross also offers policyholders a 10% discount for CPR and First-Aid courses. Also, “Curves” has reduced their $99 initial fee to only $19 if you join. The strength and cardio training will get you back into shape fast! In the Fort Wayne area, there are several discount programs including the Zoo, Civic Theater and Center For Learning.

Preventative Programs

PHP has been a pioneer in establishing programs that go beyond the typical 100% preventive benefits that are required by Obamacare plans. For example, “Sweet PHP Rewards” helps policyholders with diabetes manage their illness and treatment. Personalized coaching and elimination of copays and/or deductibles provides great incentive to adhere to the program.

“Inches Away” is designed to reimburse approved weight-loss programs for younger persons. Once the qualified program has been completed, up to $1,500 of reimbursement will be paid. Current medical coverage must be through an employer and a doctor must refer the patient for participation. Regarding the $1,500, $500 is paid after you lose 10% of your target weight loss. The final $1,000 is paid after 12 months of maintaining the lost pounds.

There are two smoking cessation programs available. PHP will pay for for authorized and approved usage of the drug CHANTIX for up to six months. If other supporting assistance accompanies the medication, the success rate will be much higher. 1-800-QUIT-NOW is also available with specially-trained representatives that provide recommendations through personal sessions. A quarterly newsletter also offers many cost-saving tips.

Coverage In Other States

You don’t have to be a Hoosier to apply for a policy. Michigan and Ohio residents (in selected counties) are also able to purchase coverage. In Ohio, the available counties are Van Wert, Defiance, Paulding, and Mercer, all located in the northwestern portion of the state. The available Michigan counties are Cass, St. Joseph, Berrien, and Branch. These four counties are located in the southern tip of the state.

Additional Information:

October 2014 – “Sweet PHP Rewards” is now available for members with diabetes. Periodic incentives are offered (reduction in copays or deductibles) when certain lifestyle changes are made in diet, frequency of blood testing and exercise. If you are a group member, complete, sign, and submit a risk assessment, you will be contacted (by phone) to begin the program.

Your health risk assessment (HRA) will be used to help determine areas of improvement (such as eliminating tobacco use and losing weight) that can be made. There are five different levels of completion that involve daily activities and tasks. In addition to copay and deductible reductions, gift cards may also be provided.

February 2016 – SEP (Special Enrollment Period) applications are available for persons that meet eligibility requirements. However, additional documentation is now required by the Department of Health and Human Services.